Real Info About How To Deal With Irs Debt

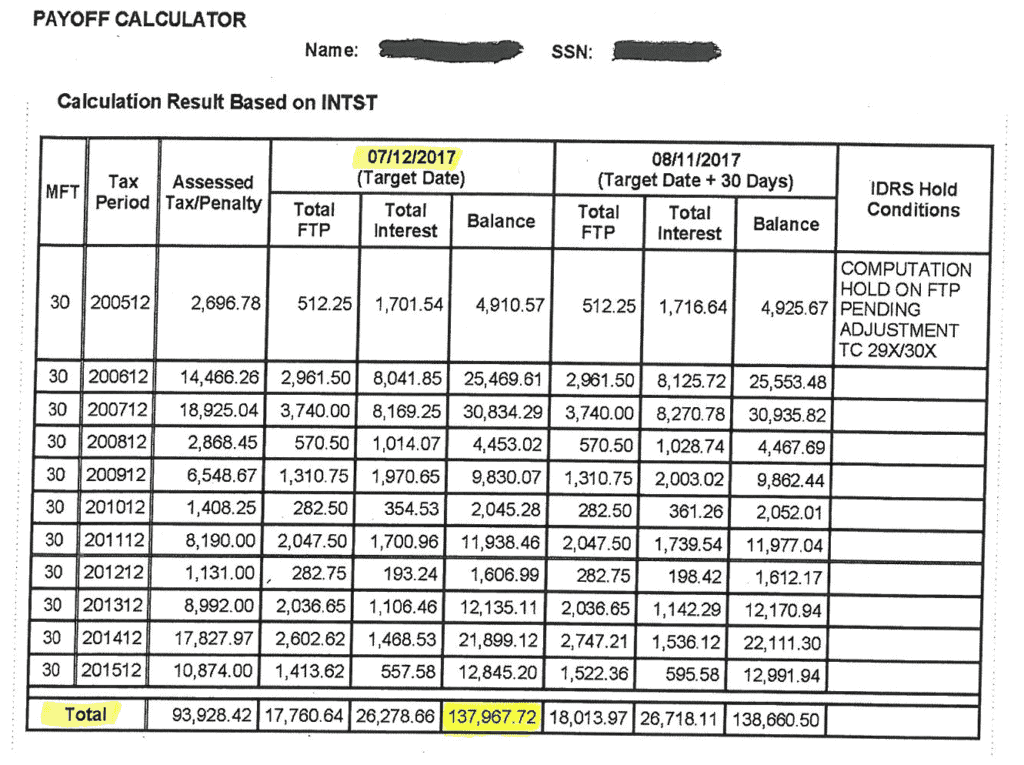

And even if they don’t take those extreme measures, the interest and penalties on your tax debt.

How to deal with irs debt. The following are the most 5 common methods people use to deal with tax debt. Request innocent spouse relief if the debt was the fault of your spouse or ex. Ad as heard on cnn.

End your irs tax problems. Ad compare the best tax relief companies & get help from qualified tax relief experts. Requesting a short deadline extension will help you avoid paying fees associated with.

Ad don't let the irs intimidate you. Use the irs statute of limitations to your advantage. Ad as heard on cnn.

End your irs tax problems. Free, competing quotes from irs tax negotiation experts. While the irs will not charge any fees for the process, they will impose a 0.5% monthly penalty on balance.

Get a free irs tax negotiation consultation. Block tax services for help dealing with an irs revenue officer if a revenue officer has been assigned to your tax situation, s.h. Congress limited the time the irs has.

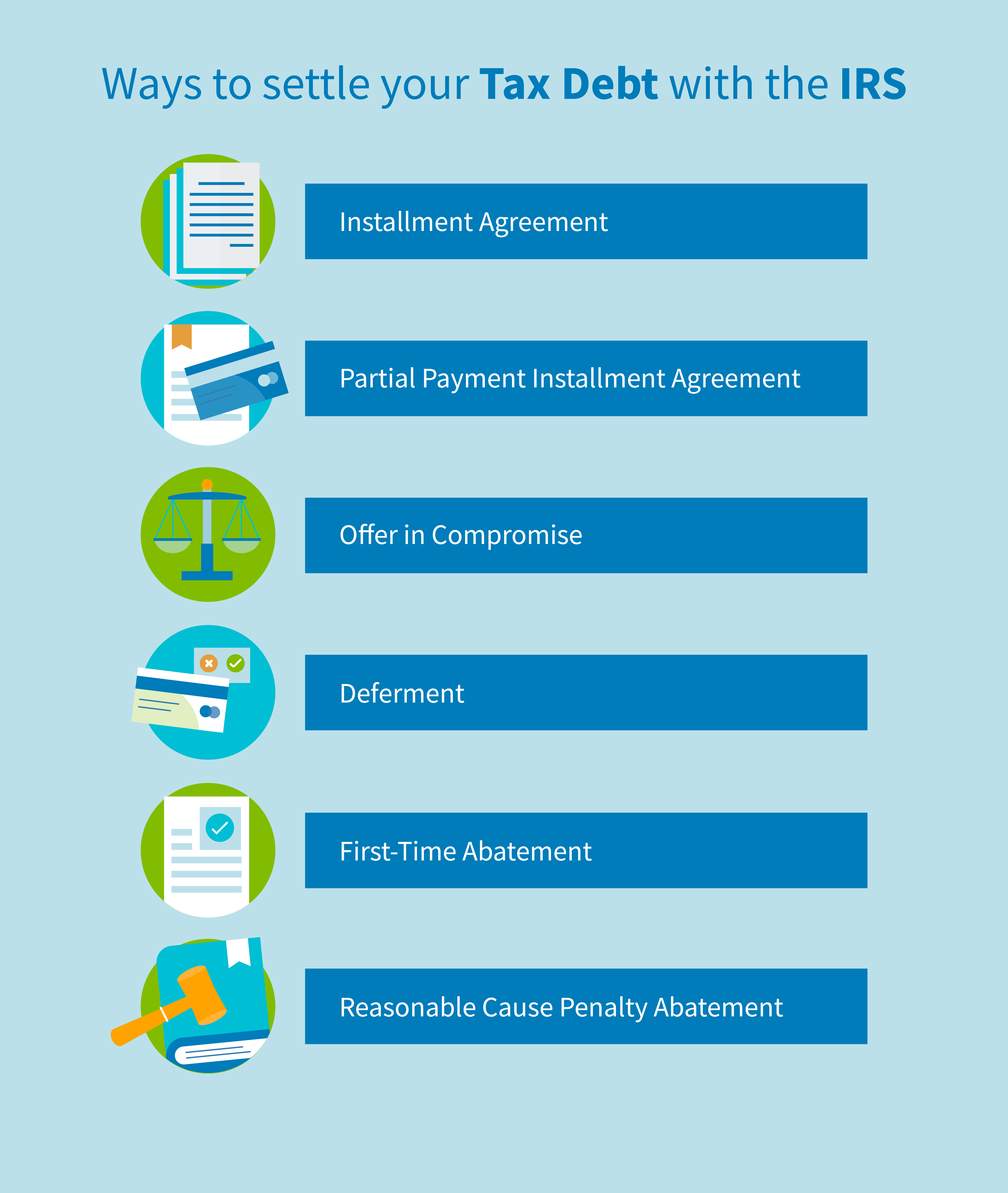

Make a payment plan, delay payment or settle request a payment plan. You've likely seen and heard ads from companies claiming they can settle your debt with the irs for pennies on the dollar. they claim you need their services to strike a deal. Dispute the tax debt on technical grounds;