Here’s A Quick Way To Solve A Tips About How To Avoid Interest Charges On Credit Cards

There’s a common myth about credit cards that has a lot of people believing that.

How to avoid interest charges on credit cards. With today's inflation, adjust your budget to include the. In addition, you'll also be charged interest on the money you take out which will accrue immediately. Tap into savings to pay.

Don't keep spending as usual. Interest charges can add up quickly, so it’s important to learn how to avoid them. Credit cards typically charge 3% to 5% for each cash advance.

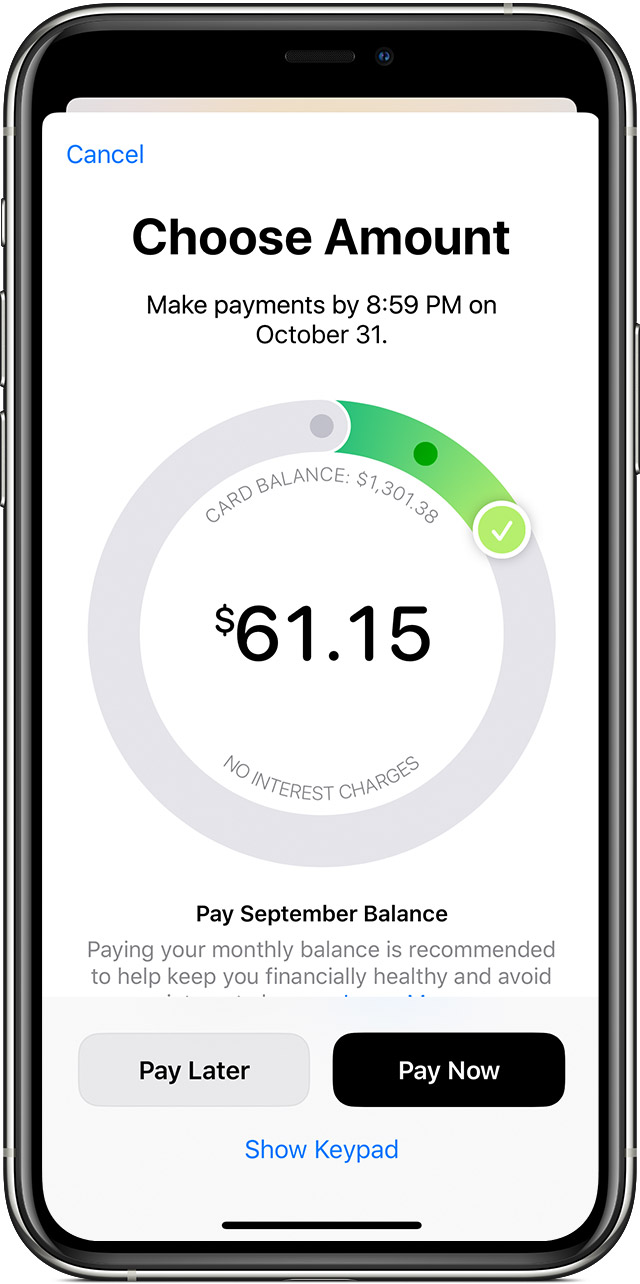

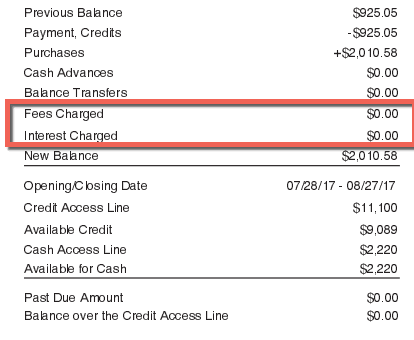

We will not charge you interest on new purchases if you pay your. How to avoid this fee:. Since finance charges are the credit card issuer's way of charging you for carrying a balance, the simple way to avoid finance charges is to pay your full balance each month.

Another way to avoid being charged credit card interest is by applying for a card offering an introductory 0% intro apr period. The average credit card interest rate in 2021 was. Here are six ways to avoid paying credit card interest fees.

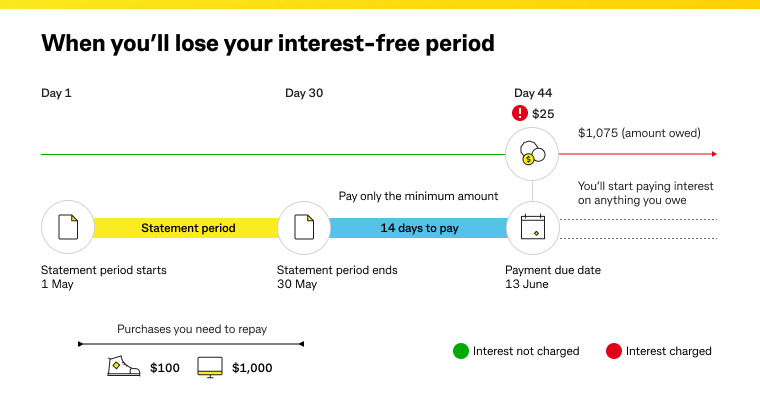

It’s common for intro apr periods to range from. Lenders and credit card issuers have different ways of calculating interest fees, and the process can get complicated. Change your budget if inflation or other circumstances are jeopardizing it.

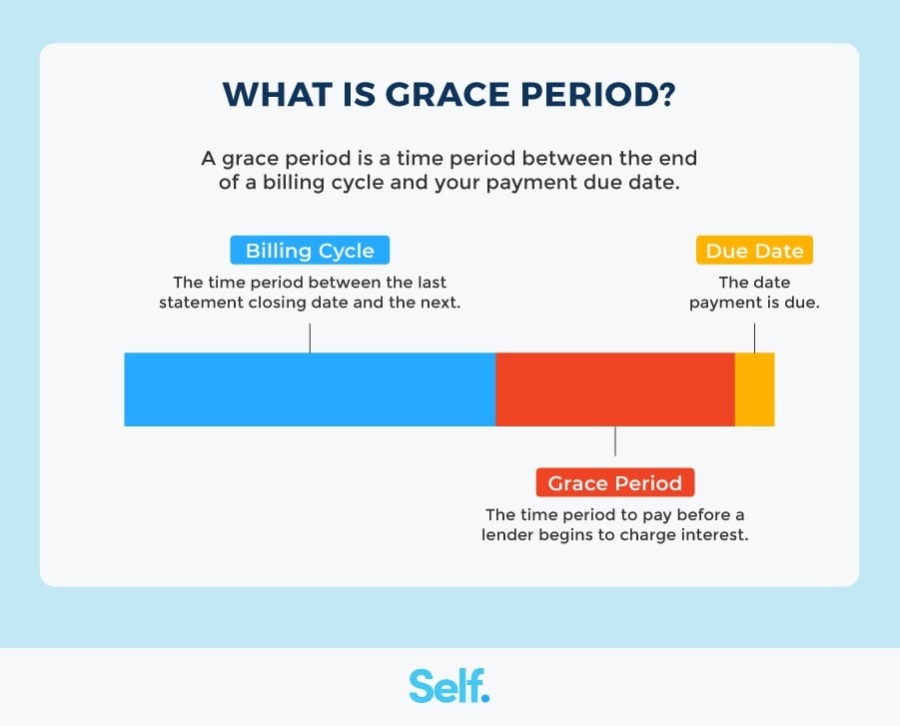

Here are a few tips: Paying your bill in full every month is the simplest way to avoid interest. Generally, you can avoid credit card interest by paying your balance in full every month before the end of the grace period.

/dotdash-050214-credit-vs-debit-cards-which-better-v2-02f37e6f74944e5689f9aa7c1468b62b.jpg)